What if your payments were super sharp? Like razor sharp? No hassles, no intermediates?

Wouldn’t that be wonderful?

This is exactly what Razorpay, one of India’s most trusted payment solutions, has made for its customers.

Picture this: You’re a small business owner in India, finally launching your dream online store. Orders start trickling in… but then comes the headache.

Customers use dozens of different payment methods like cards, wallets, UPI, net banking. Integrating them all is a technical nightmare, security is a constant worry, and tracking payments feels like untangling spaghetti.

This was the messy reality for countless Indian businesses just a few years ago.

Then came Razorpay. What started as a simple idea, make accepting online payments ridiculously easy, exploded into something much bigger.

Razorpay didn’t just solve that initial payment puzzle; it became a powerhouse fintech partner, helping businesses not just collect money, but manage it, grow it, and thrive online.

Razorpay Company Overview

Razorpay was founded in 2014 by Shashank Kumar and Harshil Mathur, two alumni of IIT Roorkee who saw a gap in India’s digital payments infrastructure. The idea was born out of their frustration with the complicated process of accepting online payments for startups.

Headquartered in Bengaluru, Razorpay has grown rapidly and is now one of India’s leading fintech companies, serving over 10 million businesses, including giants like Facebook, Airtel, Ola, and Swiggy.

And backed by investors such as Sequoia Capital, Tiger Global, and GIC, Razorpay became a unicorn in 2020 and continues to expand its offerings to simplify financial operations for businesses of all sizes.

| Founders | Shashank Kumar, Harshil Mathur (CEO) |

| Founded in | 2014 |

| Parent company | Bigo Technology Pvt. Ltd. |

| Headquartered | Bengaluru |

| Sector | Fintech, financial services |

| Website | www.razorpay.com |

Razorpay offers a wide range of services that help businesses manage payments and finances with ease. Here’s a simple breakdown of their core offerings:

- Payment Gateway

Accept payments online via credit/debit cards, UPI, net banking, wallets, and EMI—all through a single, easy-to-integrate platform.

- RazorpayX (Business Banking)

A smart banking solution for businesses. It includes current accounts, automated payroll, vendor payments, tax filing, and real-time financial insights.

- Razorpay Capital

Provides instant working capital loans, credit lines, and early settlements to help businesses manage cash flow and growth without delays.

- Payment Links & Pages

For businesses without a website, Razorpay offers simple tools like payment links and customizable pages to collect payments via SMS, email, or social media.

- Subscriptions

Automates recurring payments for businesses that charge customers weekly, monthly, or yearly—ideal for SaaS and membership models.

- Route

Allows businesses to split payments automatically between multiple vendors, partners, or accounts based on predefined rules.

- Smart Collect

Generates virtual accounts and UPI IDs for businesses to collect payments with auto-reconciliation, which are useful for marketplaces or aggregators.

- QR Codes & UPI Payments

Enables offline merchants to accept contactless payments via dynamic or static QR codes.

- Razorpay POS (Point of Sale)

A recent addition, allowing physical stores to accept card and UPI payments via card swiping machines.

These services together make Razorpay an end-to-end financial infrastructure provider for modern Indian businesses.

Razorpay 4Ps of Marketing

RAZORPAY

4Ps OF MARKETING

PRODUCT

- Full-stack payment & banking solutions

- Payment Gateway, RazorpayX, Capital, Subscriptions, POS

- Developer-friendly, secure, and easy to integrate

PRICE

- Full-stack payment & banking solutions

- ~2% transaction fee (standard)

- Custom pricing for enterprises

- No setup or hidden fees

PLACE

- 100% digital onboarding & operations

- Pan-India coverage

- API-first, cloud-based platform

- API-first, cloud-based platform

- Seamless integration with major eCommerce platforms

PROMOTION

- Content & performance marketing

- Fintech reports & thought leadership

- Webinars, events, startup partnerships

- Strong PR around growth & innovation

Below is a breakdown of the 4Ps of marketing for Razorpay.

Product

Razorpay offers a full-stack suite of financial products designed for businesses of all sizes:

- Payment Gateway for online payments via UPI, cards, wallets, etc.

- RazorpayX for business banking, payroll, and vendor payouts

- Razorpay Capital for loans and working capital

- Subscriptions, Payment Links, Smart Collect, POS, and more

The product is known for being developer-friendly, easy to integrate, and secure.

Price

Razorpay follows a transparent, pay-as-you-go pricing model, making it accessible to startups, SMEs, and large enterprises.

- No setup fee for most services

- Competitive transaction charges (e.g., ~2% per transaction)

- Custom pricing for large-scale or enterprise users

They also offer tailored plans and discounts based on business size and transaction volume.

Place

Razorpay operates 100% digitally.

- Businesses can sign up and integrate Razorpay online without visiting any office.

- They serve pan-India and are expanding in Tier 2 and 3 cities as digital adoption grows.

- Their platform is API-driven and cloud-based, so onboarding and operations are remote and seamless.

Promotion

Razorpay promotes itself through:

- Content marketing (blogs, guides, fintech reports)

- Performance marketing (Google Ads, LinkedIn, Facebook)

- Partnerships with incubators, co-working spaces, and developer communities

- Events and webinars targeting startups and SMEs

- PR campaigns around product launches, funding rounds, and fintech innovation

Their tone is helpful, technical yet approachable—positioning them as a modern, trustworthy fintech partner.

Razorpay On-page SEO and Technical Optimization

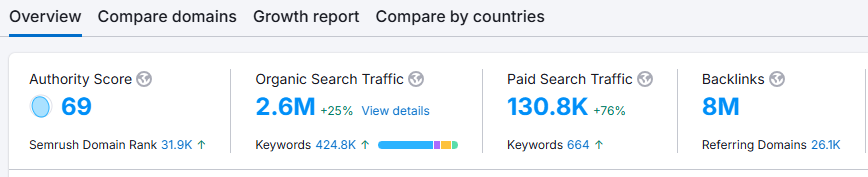

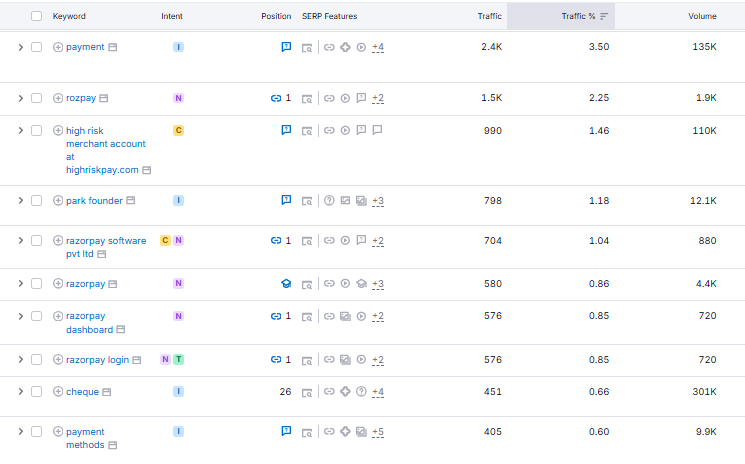

Razorpay has built a powerful online presence, backed by impressive SEO and paid marketing performance:

- Authority Score: 69

A strong domain authority score that reflects Razorpay’s credibility and trustworthiness in the fintech space. - Organic Search Traffic: 2.6 Million/month (+25%)

Razorpay ranks for over 424,000 keywords, attracting millions of monthly visitors through search. This highlights the strength of their content strategy, technical SEO, and brand visibility. - Paid Search Traffic: 130.8K/month (+76%)

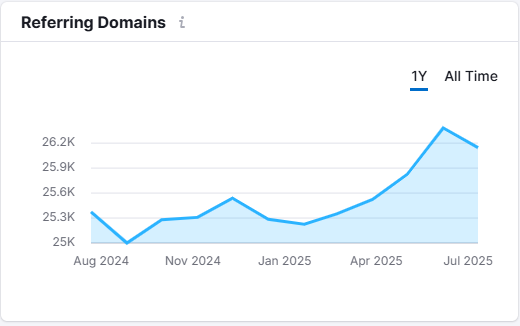

With over 664 keywords targeted via ads, Razorpay effectively uses paid campaigns to complement their organic reach—especially for high-converting or competitive terms. - Backlinks: 8 Million

An outstanding backlink profile, with links from over 26,000 referring domains. This reflects strong digital PR, partnerships, and valuable content that other websites link to.

This data clearly shows how Razorpay leverages a dual engine of organic SEO and performance marketing to dominate the fintech search landscape, drive traffic at scale, and stay top-of-mind for businesses across India.

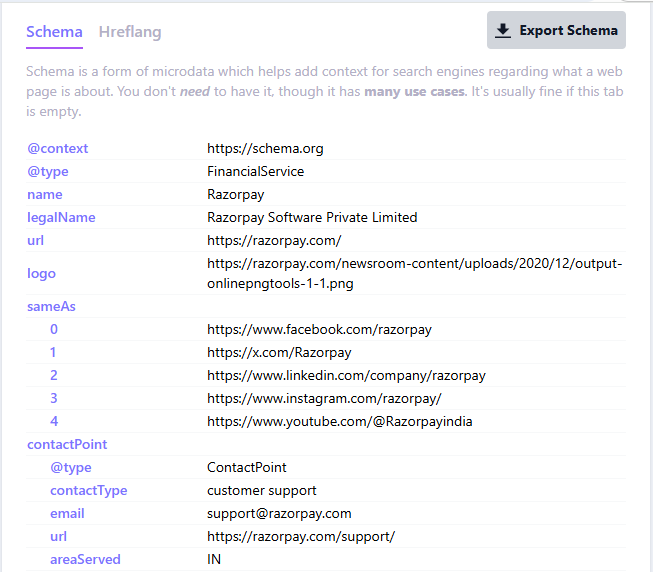

Technical SEO Highlights

- Clean URL Structure

Razorpay maintains a logical, keyword-rich URL hierarchy with pages like /payment-gateway/, /learn/, and /support/. This not only improves user experience but also helps search engines understand and rank the site more effectively.

- Schema Markup Implementation

To enhance visibility in search results, Razorpay uses structured data such as:

- FAQ Schema – for expandable Q&As in SERPs

- Product Schema – to provide detailed service info

- LocalBusiness Schema – to improve local search presence

These schemas boost click-through rates by enabling rich snippets.

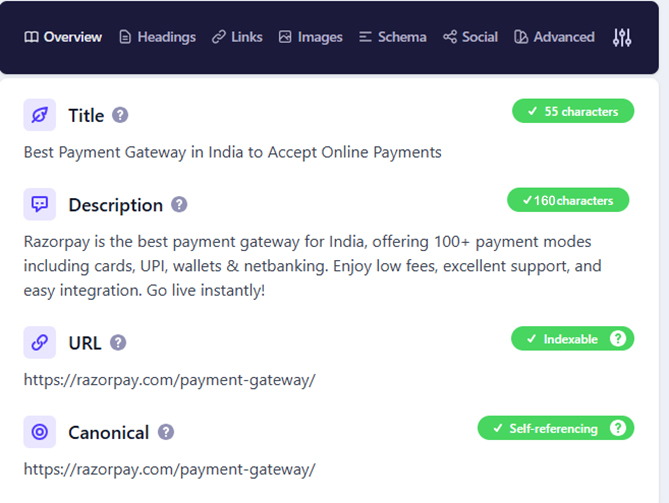

- Meta Titles & Descriptions

All pages have well-optimized, branded meta titles and descriptions that naturally include target keywords. This not only improves rankings but also encourages more clicks from searchers.

- Canonical Tags

To prevent duplicate content issues, especially across knowledge base articles, guides, and blog posts, Razorpay uses canonical tags effectively. This ensures SEO equity is consolidated and not diluted across similar URLs.

SEO & Keyword Strategy

Razorpay’s SEO approach is both strategic and structured, targeting users at every stage of the buyer journey with tailored content.

1. Targeting by Funnel Stage

- Bottom of Funnel (BOFU):

Focused on high-intent keywords like “best payment gateway for startups” and “payment gateway without website” to capture users ready to convert.

- Middle of Funnel (MOFU):

Targeted educational queries like “how to integrate payment API” and “recurring payments in India” to assist evaluation-stage users.

- Top of Funnel (TOFU):

Created thought leadership content around broader keywords like “digital payment trends in India” and “UPI vs card payments” to attract awareness-level traffic.

2. SEO Execution

- Hub-and-Spoke Model:

Razorpay built strong internal architecture with pillar (hub) pages like “Payment Gateway”, “Payroll”, and “RazorpayX”, supported by spoke pages such as feature breakdowns, FAQs, blog articles, and use cases. This structure improved both topical authority and user navigation.

- Content Pruning with the 6R Strategy:

Low-performing or outdated content was Retired, Refreshed, or Repurposed to maintain quality across the site. This clean-up reduced keyword cannibalization and improved page performance sitewide.

3. Results

After pruning and consolidating underperforming URLs, Razorpay saw a 122% increase in TOFU organic traffic, proving the effectiveness of their content cleanup and structured SEO strategy.

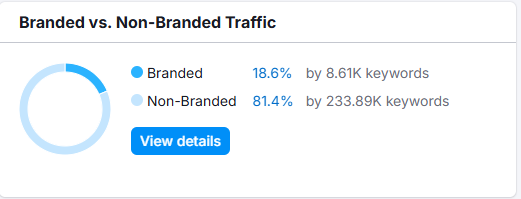

Over 81% of Razorpay’s search traffic comes from non-branded keywords, showing the strength of its SEO strategy in capturing high-intent users who may not yet know the brand.

Also, with visibility across 233K+ non-branded keywords, Razorpay isn’t just relying on name recognition, it’s winning search through relevant, intent-driven content that targets every stage of the buyer journey.

Top of Funnel (TOFU) – Awareness

At the awareness stage, Razorpay uses blog articles, industry reports, and infographics to educate users on broad topics like fintech, payments, GST, and UPI. The goal is to attract and inform potential customers early in their journey by providing valuable, keyword-rich content.

This article explains payroll in simple terms, making Razorpay discoverable to HR professionals and business owners researching payroll systems.

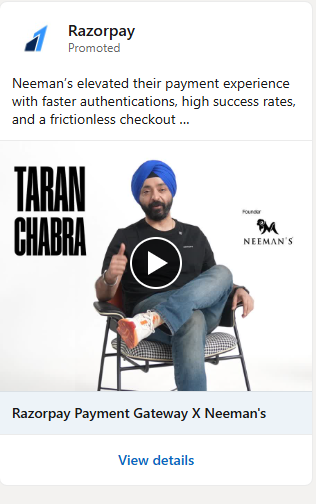

Middle of Funnel (MOFU) – Consideration

In the consideration stage, Razorpay creates case studies, comparison guides, and webinars to showcase how its solutions work in real-world scenarios. The goal is to build trust and demonstrate product fit for specific industries and business needs.

Example: How Razorpay Helped Nerolac Add Digital Payments to Their Palette

This case study highlights Razorpay’s role in helping a major paint brand streamline payments, offering proof of impact to decision-makers evaluating options.

Bottom of Funnel (BOFU) – Conversion

At the conversion stage, Razorpay focuses on content that removes final objections and simplifies onboarding. This includes integration guides, product demos, and ROI calculators, which are resources designed to show value and make adoption easy.

This blog walks users through a specific feature that directly impacts revenue, helping convert leads who are close to making a decision.

Backlinks Strategy

Razorpay has built a strong and diverse backlink profile with 26,000 referring domains. The majority of these links come from high-authority sources, including leading fintech publications, digital media outlets, tech blogs, and developer portals.

This diverse mix, spanning industry news sites, government/finance portals, and strategic partner domains not only boosts Razorpay’s domain authority but also strengthens its credibility across multiple verticals.

Outbound Linking Strategy

Razorpay takes a thoughtful approach to outbound links, using them sparingly but strategically.

They frequently link to trusted partners like Shopify, Zoho, and incubators, as well as to research sources and product integration pages. These links provide context, reinforce trust, and support the user journey, without diluting page authority or risking spam signals.

Categories of Referring Domains

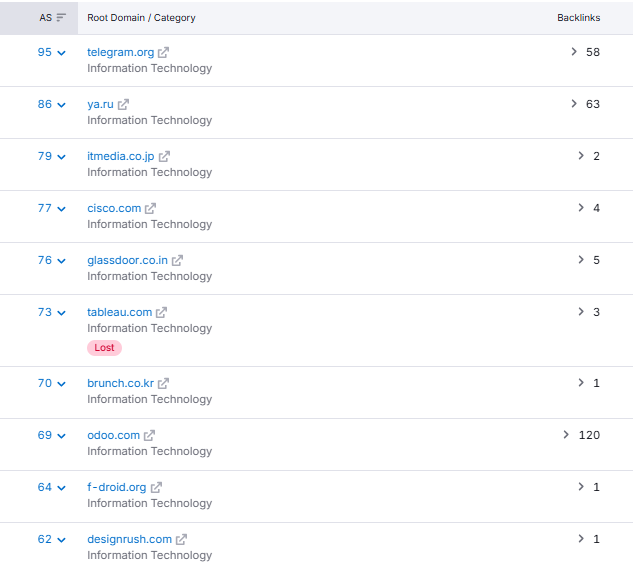

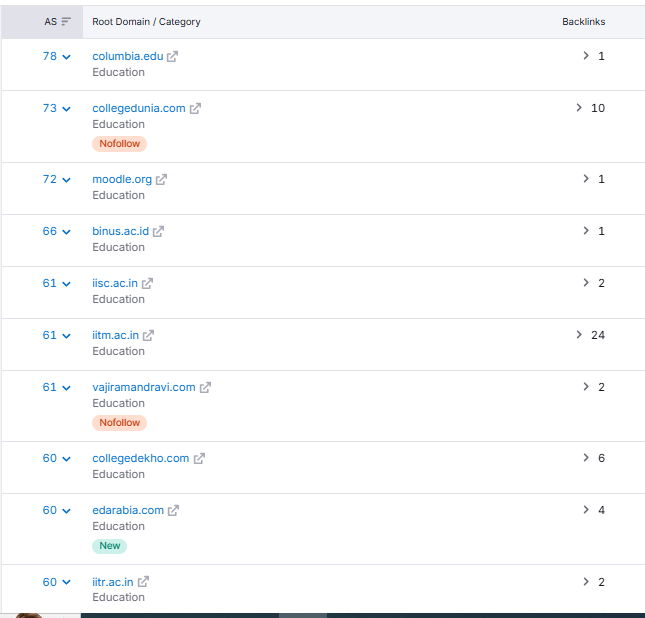

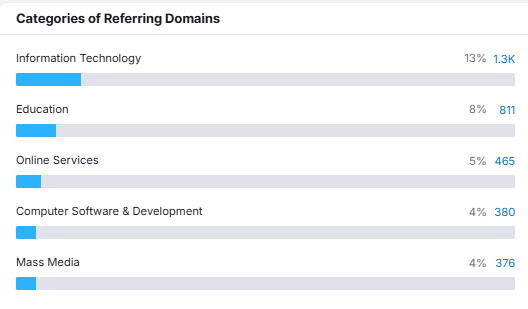

Razorpay’s backlink profile spans a wide range of credible industries, further boosting its domain trust and SEO strength:

- Information Technology (13%) – The largest share of backlinks (~1.3K domains) comes from IT-focused sites, reflecting Razorpay’s relevance in the tech and SaaS space.

- Education (8%) – With 811 domains, educational institutions and learning platforms cite Razorpay in fintech learning content, reports, and training materials.

- Online Services (5%), Software Development (4%), and Mass Media (4%) – These collectively contribute hundreds of quality links, indicating Razorpay’s widespread industry footprint—from service providers and dev communities to media publications.

This well-distributed domain mix strengthens Razorpay’s authority across multiple verticals and helps diversify its traffic sources organically.

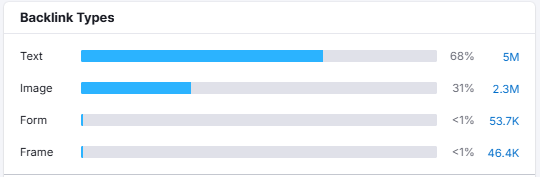

Types of Backlinks

Razorpay’s backlink profile is primarily made up of text-based links, which account for 68% (5 million) of total backlinks. These are often found in blog mentions, news articles, and partner features, helping pass both authority and context.

Image-based links make up 31% (2.3 million), likely from media placements, logos, and visual content shared across the web. The remaining backlinks come from forms and iframes, which contribute less than 1% and have minimal SEO impact.

This healthy mix, led by text links, indicates strong editorial referencing and natural content-driven linking, both key to long-term SEO authority.

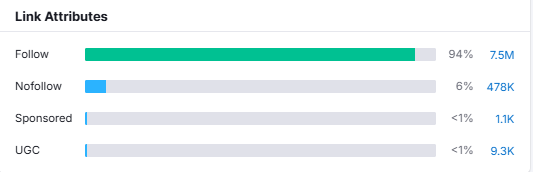

Link Attributes

A strong 94% of Razorpay’s backlinks are follow links—around 7.5 million in total. These links directly pass SEO value, boosting Razorpay’s domain authority and search rankings.

Only 6% are nofollow (478K), with minimal presence of sponsored and UGC links (<1%). This signals a high level of editorial trust, as most links come from organic mentions rather than ads or user-generated content.

Overall, this distribution reflects Razorpay’s authority-driven link profile and the success of its organic outreach and content strategies.

Razorpay Social Media Marketing

Now, let’s take a look at the social media marketing strategy of Razorpay, and the channels they use.

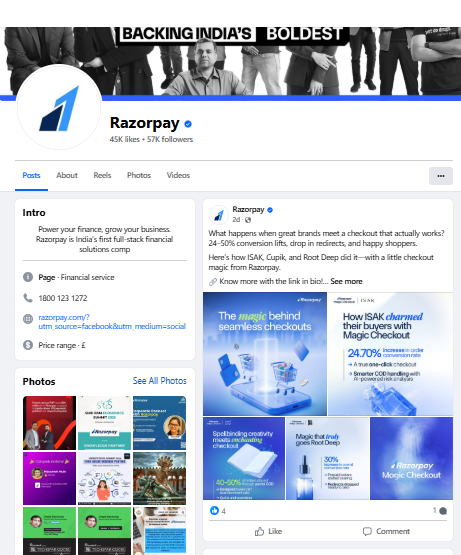

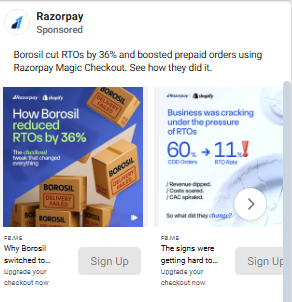

Facebook

Followers: 57k

Razorpay used Facebook as a performance and brand-building channel, running strategic video campaigns to drive product awareness, especially around Magic Checkout.

The funnel-driven approach (Capture → Nurture → Convert) allowed Razorpay to retarget engaged users (e.g., 3-second video viewers and site visitors) with testimonial-led carousel and collection ads.

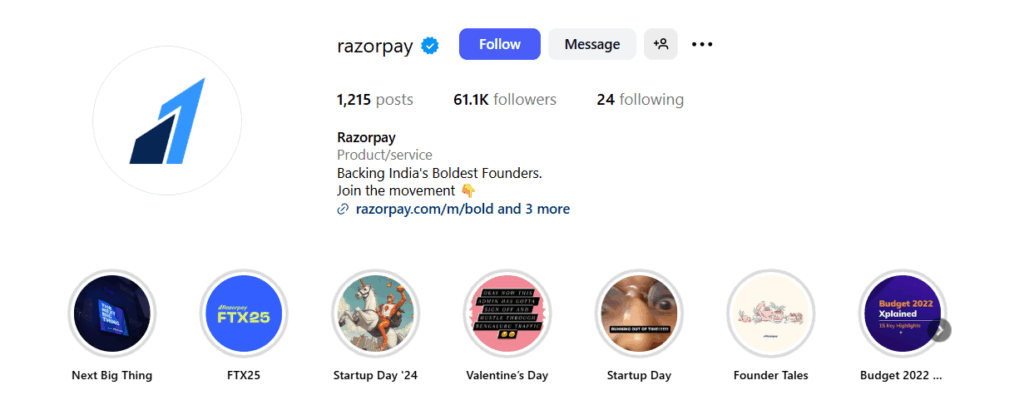

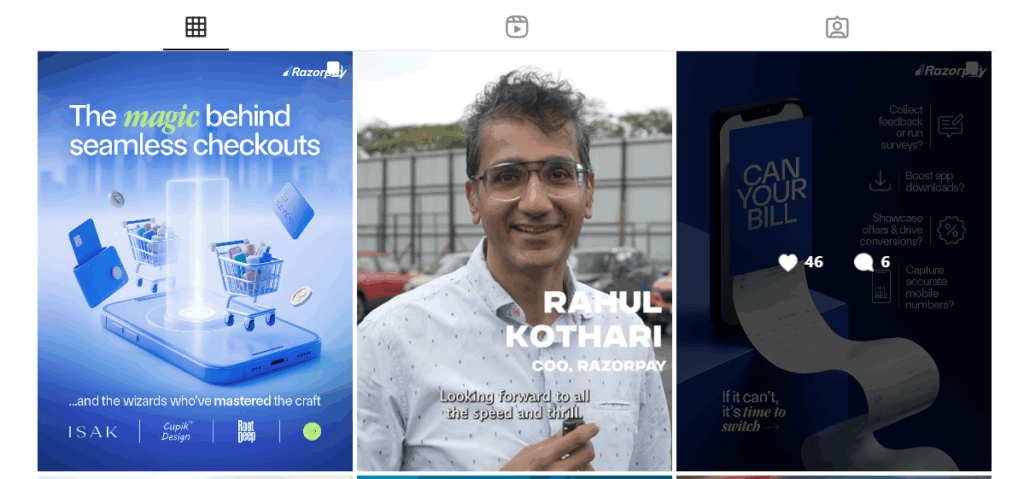

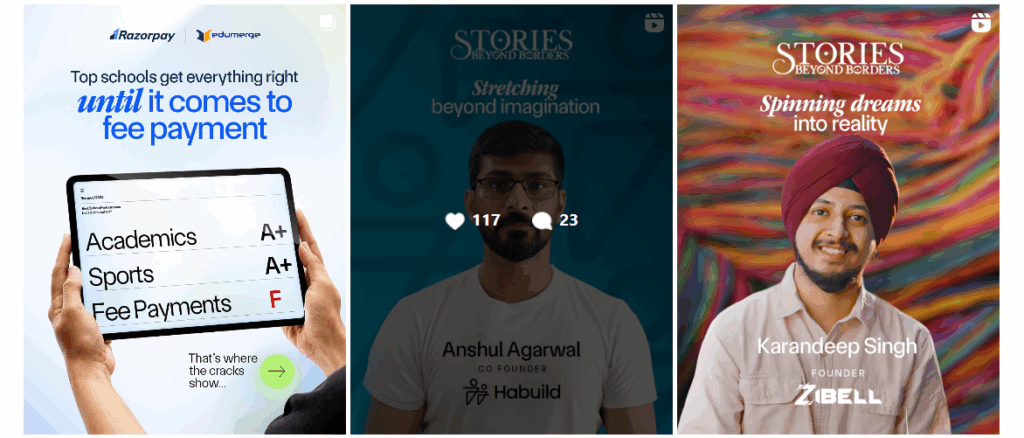

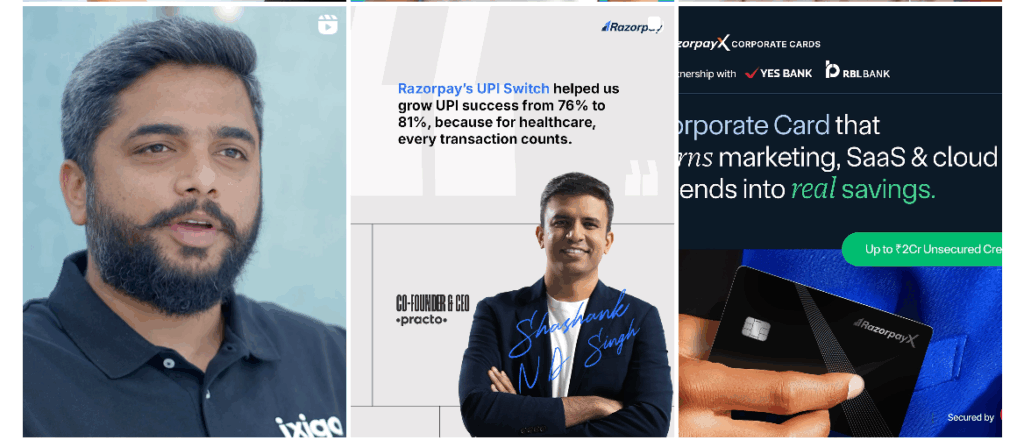

Instagram

Followers: 61.1 k

Razorpay’s Instagram feed smartly blends founder stories, product features, and aspirational branding into a cohesive visual strategy, which are all tailored to appeal to India’s new-age businesses and startup community.

- Storytelling with Founders

Their “STORIES” series puts a spotlight on bold founders who use Razorpay. By showcasing real people (like Anshul Agarwal of Hubuild and Karandeep Singh of Zibell), Razorpay reinforces product credibility through human success narratives and not just specs and features.

- Product Simplification Through Metaphors

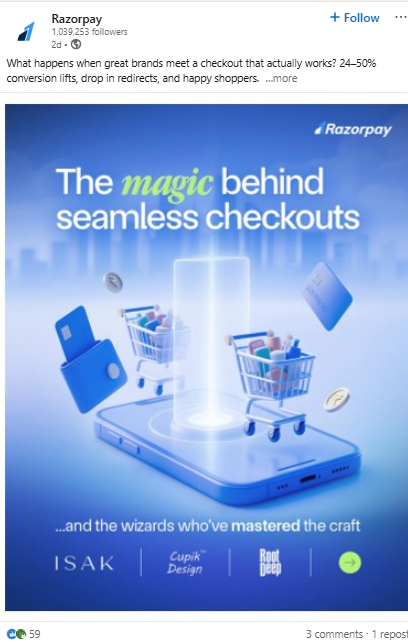

Posts like “The Magic Behind Seamless Checkouts” or “Can Your Bill Do This?” turn technical offerings into easy-to-grasp visual stories. This not only educates but makes the content scroll-stopping, a smart move for attention on Instagram.

- Branded Visual Identity

From colour gradients to typography, Razorpay maintains a modern and unified visual identity that feels premium and startup-centric. It subtly communicates: “We’re for the bold and the tech-forward.”

- Trust Through Thought Leadership

Posts featuring leaders like Rahul Kothari (COO) or highlighting payment infrastructure updates show Razorpay as not just a service provider, but a thought leader driving fintech evolution in India.

- Community-Focused Content

Whether it’s education-centric posts like “Free Payments for Schools” or UPI innovations for SMBs, Razorpay speaks directly to its core audience, which are Indian entrepreneurs, with relevant, niche content that resonates.

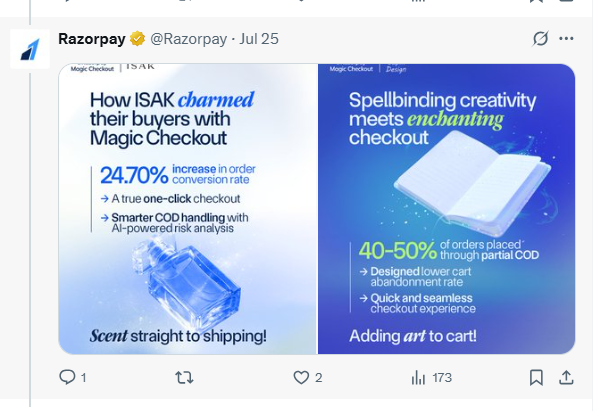

Followers: 29.5k

Razorpay uses its Twitter platform to drive product education and adoption, without sounding dry or overly technical. Here’s how:

- Data-Driven Storytelling

Each tweet in the “Magic Checkout” thread shares crisp, conversion-focused data points (e.g. “24.70% increase in checkout success” for ISAK or “40–50% faster checkout time”). This builds trust and positions Razorpay as a results-driven product, critical for B2B buyers.

- Case-Study Inspired Content

Instead of generic claims, Razorpay name-drops real D2C brands (ISAK, Cuplk, Root Deep) to highlight success stories. These mini case studies double as social proof and help potential customers relate.

- Consistent Branding & Visual Style

With its cool-toned gradients, 3D-style illustrations, and repetition of the word “magic,” the campaign creates a memorable, thematic visual identity across tweets. This boosts recall and brand cohesion.

- Clever Copy Hooks

Phrases like “Spellbinding creativity meets enchanting checkout” and “It feels like magic” add a touch of personality and intrigue, making otherwise functional content more emotionally engaging.

Followers: 1M

Razorpay’s LinkedIn strategy focuses on building trust and thought leadership by spotlighting its founders, showcasing real client success stories, and actively participating in ecosystem events.

Their posts blend product storytelling with subtle brand promotion, like demonstrating how “Magic Checkout” boosts conversion rates, while maintaining a consistent visual identity using clean, blue-toned graphics.

The content is crafted to engage a professional audience with a mix of data, insights, and community engagement, positioning Razorpay as both an innovator and enabler in the fintech space.

PPC – Performance Marketing Strategy

Razorpay runs a focused performance marketing strategy to drive merchant onboarding and Magic Checkout integrations, using a mix of Search Ads and Performance Max (PMax) campaigns.

Objectives & Campaign Types

- Promote core offerings like Payment Gateway, Magic Checkout, and RazorpayX

- Leverage Search and PMax campaigns for intent-based and broader reach

Structure & Targeting

- Separate campaigns for each product to improve relevance and tracking

- SKAGs (Single Keyword Ad Groups) used for high-intent search terms

- Exact & Phrase match for transactional queries like “UPI payment gateway”

- Broader coverage through Dynamic Search Ads (DSA) and PMax targeting

Ad Optimizations

- Copy emphasizes clear value propositions like “No website needed” or “Automated payroll”

- Use of rich ad extensions: sitelinks, callouts, structured snippets, and call extensions to improve CTR and user navigation

Landing Pages

- Fast-loading, dedicated landing pages tailored to each product

- Clear CTAs, real use cases, and conversion-driven content like case studies and ROI metrics

Meta Ads (Facebook & Instagram) Strategy

The Meta Ads strategy followed a Capture → Nurture → Convert funnel.

It started with video ads to build brand awareness and drive quality engagement, followed by retargeting viewers (e.g., 3-second views) with product-focused content.

Custom audiences were built from video engagers, webinar attendees, and site visitors, while lookalikes were generated using purchaser data and CRM lists.

Warm audiences such as cart abandoners and page engagers were retargeted with carousel, video, and collection ads featuring product benefits and testimonials.

LinkedIn Ads Strategy

Razorpay’s LinkedIn strategy focused on targeting professional decision-makers, CFOs, founders, and eCommerce heads, ideal for enterprise onboarding and product-led campaigns.

Automated workflows via the LinkedIn Ads API (e.g., syncing ad lists based on purchase activity through Zapier) enabled efficient audience updates.

The campaign leveraged sponsored content like leadership insights, case studies, and founder posts, while Lead Gen Forms captured high-touch inquiries seamlessly.

Final Thoughts

Struggling to get found on Google?

At Nico Digital, we turn underperforming websites into high-traffic growth engines. Whether you need better rankings, more qualified leads, or content that actually converts, our SEO strategies are built to deliver real, measurable results.

Let’s make your website work harder.

Partner with Nico Digital and start winning on search!