When it comes to choosing the right insurance plan, we Indians tend to be in a bit of a soup. Simply because we are flooded with multiple insurance offers, from multiple vendors, some of which seem too good to be true.

And choosing the right one feels like trying to pick the ripest mango from a basket full of lookalikes, that too with your aunt shouting “Beta, LIC le lo!” in the background.

Well, not anymore. Thanks to Ditto Insurance.

Founded by ex-IIM graduates, Ditto performs one major role – to demystify insurance for the average Indian consumer.

Specializing in health and term-life insurance, Ditto has grown from a humble startup in 2020, to securing a place in LinkedIn’s Top 20 Indian Startups in 2023!

How? Let’s find out through this deep-dive marketing case study that unpacks how Ditto won trust, clicks, and hearts, without sounding like your average insurance agent.

Company Overview

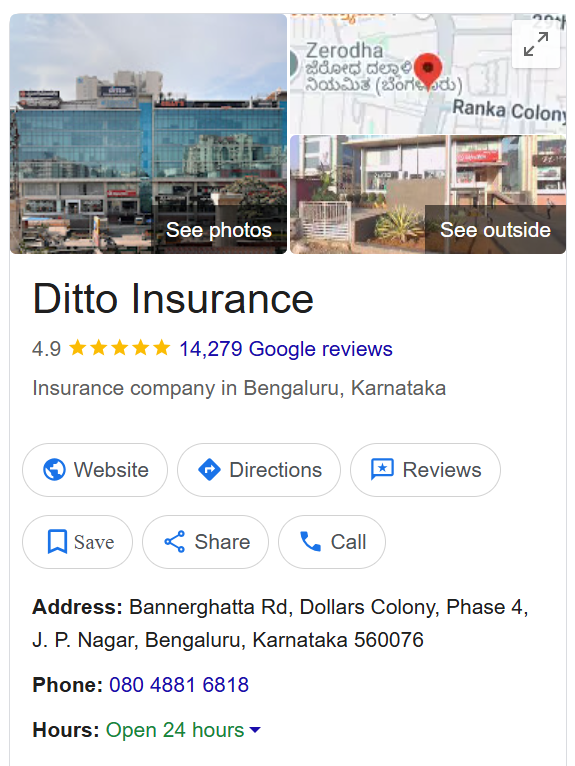

Ditto Insurance is a Bengaluru-based digital insurance advisory platform, founded in late 2020/early 2021 by ex-IIM-A teammates Shrehith Karkera, Bhanu Harish Gurram, Pawan Kumar Rai, and later Lokesh Gurram. Operating under Tacterial Consulting Pvt Ltd, it holds an IRDAI corporate agent license and specializes in health and term-life insurance.

The company was first called Finshots, which simplifies financial news. And the Ditto of today was born out of this, and aims to demystify insurance for everyday consumers. The founders suited up to tackle policy confusion and mis-selling, bringing informed, personalized advisory to the mainstream. Ditto’s unique proposition lies in its human-led advisory approach, which is no spam, no pressure, and no commission-driven selling.

As of today, Ditto is India’s top-rated insurance advisor with a 4.9 Google rating from over 12,000 customers.

Ditto’s Digital Marketing Strategy In A Nutshell

Before we start uncovering Ditto’s marketing strategy, let’s look at its digital marketing strategy in a nutshell.

Ditto’s goal is to drive qualified traffic, boost policy inquiries, and build lasting trust in a high-stakes, trust-sensitive industry.

Their core marketing pillars are the following.

Core Pillars:

- SEO: To capture organic traffic and generate high-intent leads through keyword-optimised educational content.

- Content Marketing: To simplify complex insurance topics and build credibility through blogs, explainers, and newsletters.

- PPC: To target bottom-of-funnel users actively searching for insurance, driving immediate inquiries and sign-ups.

- Social Media: To raise brand awareness and educate younger audiences through relatable, bite-sized content.

- Retention: To enhance lifetime customer value through post-sale support, claim guidance, and regular engagement.

Ditto’s UI/UX Study

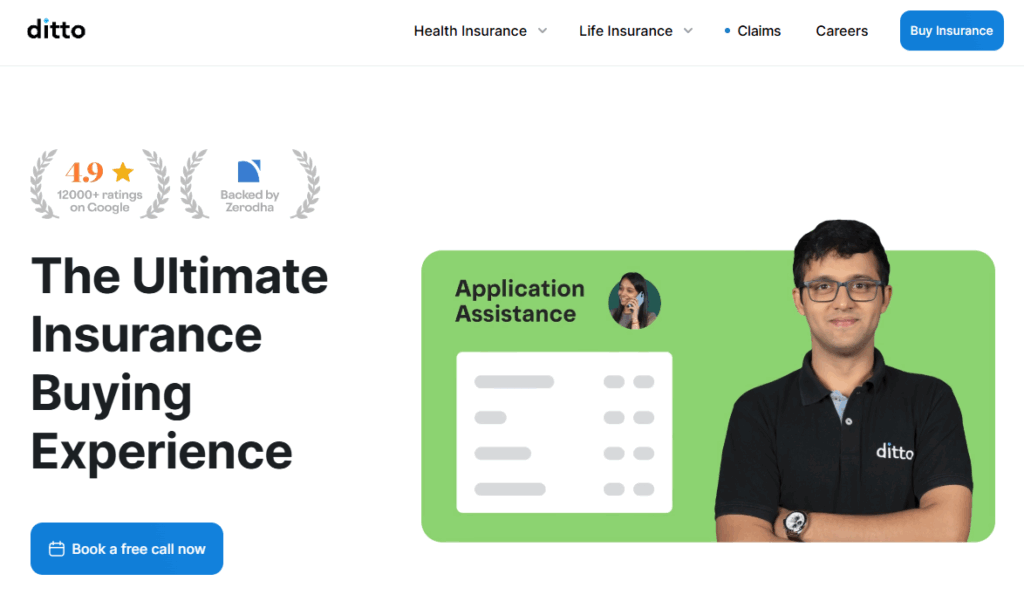

The homepage of Ditto Insurance delivers a clean, trust-first user experience with a clear and conversion-focused hero section.

Below is a breakdown of key UI/UX elements.

1. Hero Section (Above the Fold)

Visual Hierarchy & Clarity

The hero section is uncluttered, with bold typography that states the core value proposition:

“The Ultimate Insurance Buying Experience.”

This immediately communicates trust, simplicity, and value—all vital in a high-stakes industry like insurance.

Trust Signals

- 4.9⭐ Google rating with 12,000+ reviews

- Backed by Zerodha—a name widely trusted in fintech

These elements are placed prominently to build instant credibility.

Call to Action (CTA)

The CTA button “Book a free call now” is clear, friendly, and low-pressure. Its blue colour stands out against the white background, making it visually prominent and action-oriented.

Human Touch

A Ditto advisor is pictured on the right, wearing branded clothing and confidently smiling. This adds a human element and reinforces their “advisor-first, not seller-first” positioning. Alongside, a UI card mockup showing “Application Assistance” subtly introduces users to the service flow without overwhelming them.

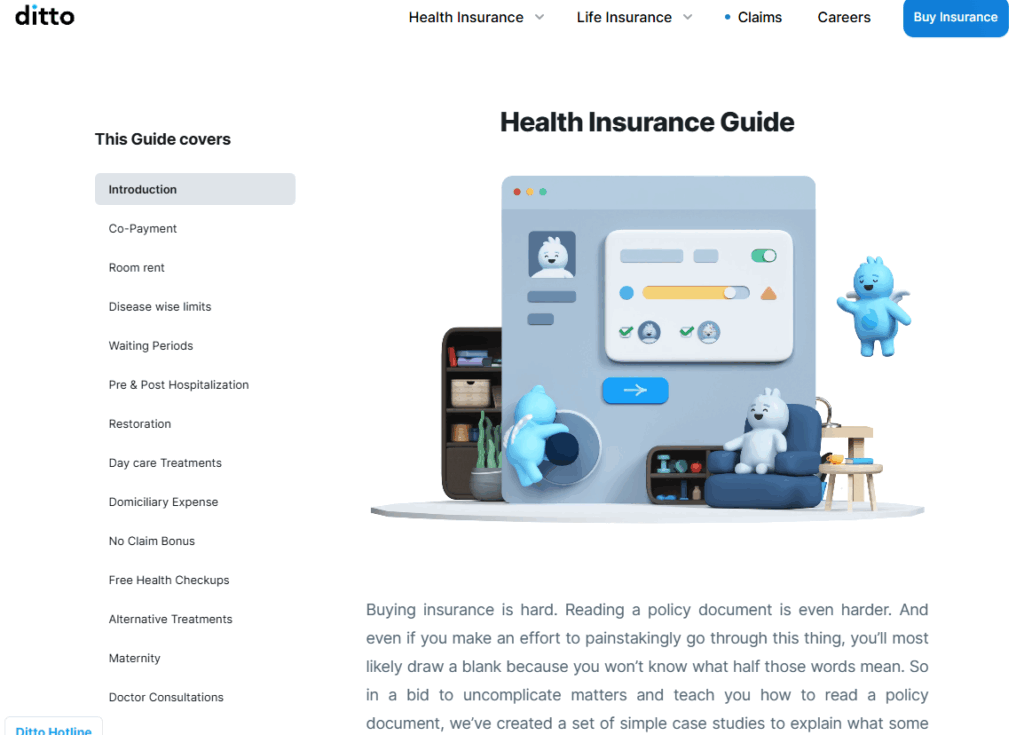

2. Navigation (Top Menu)

The sticky top menu is straightforward, offering dropdowns for:

- Health Insurance

- Life Insurance

- Claims

- Careers

A clear “Buy Insurance” button in the top-right corner serves as a secondary but consistent CTA across the site.

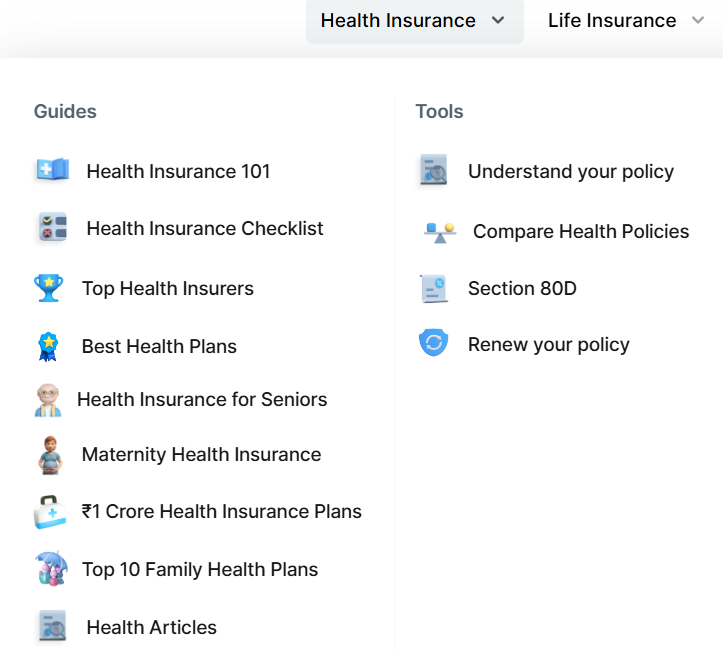

The Health Insurance tab on Ditto’s website is a well-structured, user-centric dropdown that balances education and utility. It’s neatly divided into two sections and Tools. This makes it easy for users to explore based on their intent.

The Guides section includes beginner-friendly resources like Health Insurance 101 and the Checklist, alongside niche topics like Maternity Health Insurance, Insurance for Seniors, and curated picks such as Top Health Insurers and ₹1 Crore Health Insurance Plans.

On the other side, the Tools section empowers users to take actionable steps, such as comparing policies, understanding Section 80D tax benefits, or renewing an existing plan.

Each subsection of the menu, like “Health Insurance 101,” has a detailed guide for users to understand each and every aspect of buying health insurance and claiming it when the situation arises.

The total word count is 3817 words, which showcases the level of depth and effort Ditto puts into educating its users.

The “Tools” tab has sections like “Understand Your Health Insurance Policy,” which is a detailed landing page, complete with tools to check different health insurance policies provided by different companies.

Ditto uses a compelling and trust-rich CTA banner that encourages users to speak with IRDAI-certified experts for free.

This CTA not only reassures users who feel overwhelmed by insurance jargon but also reinforces Ditto’s no-spam and human-first approach.

The page ends with a detailed Frequently Asked Questions section to help users get clear answers to common doubts about health insurance.

From understanding the right cover amount to knowing how and when to pay premiums, these FAQs are written in simple, easy-to-understand language. This not only improves the user experience but also supports SEO by covering long-tail keyword queries and voice search phrases.

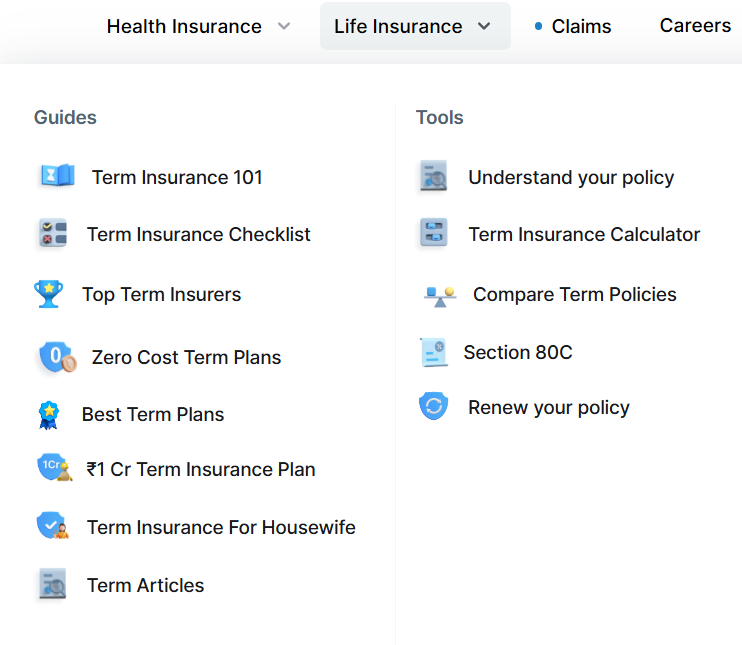

The Life Insurance tab on Ditto’s website mirrors the user-friendly structure of its health counterpart, thoughtfully divided into Guides and Tools to cater to both new and returning users.

The Guides section features beginner content like Term Insurance 101 and Term Insurance Checklist, alongside more targeted reads such as Zero Cost Term Plans, ₹1 Cr Term Insurance Plan, and even Term Insurance for Housewife, showcasing inclusivity and personalization.

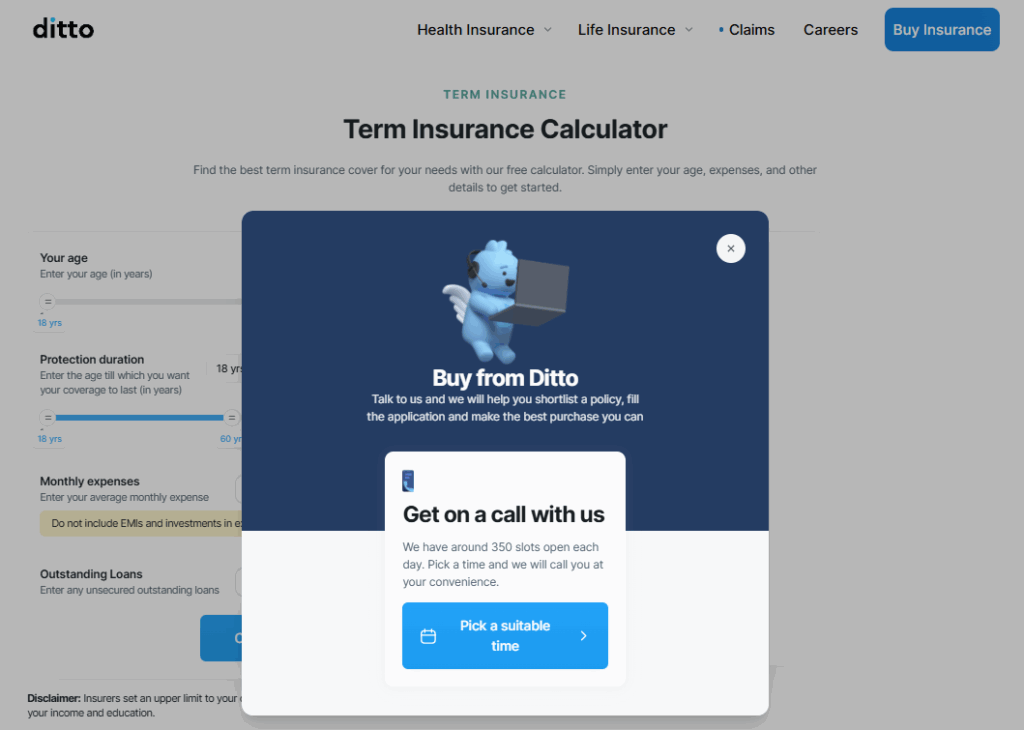

Meanwhile, the Tools section is action-oriented, offering resources like a Term Insurance Calculator, Compare Term Policies, and policy-related help, including Section 80C tax insights and a Renew your policy option.

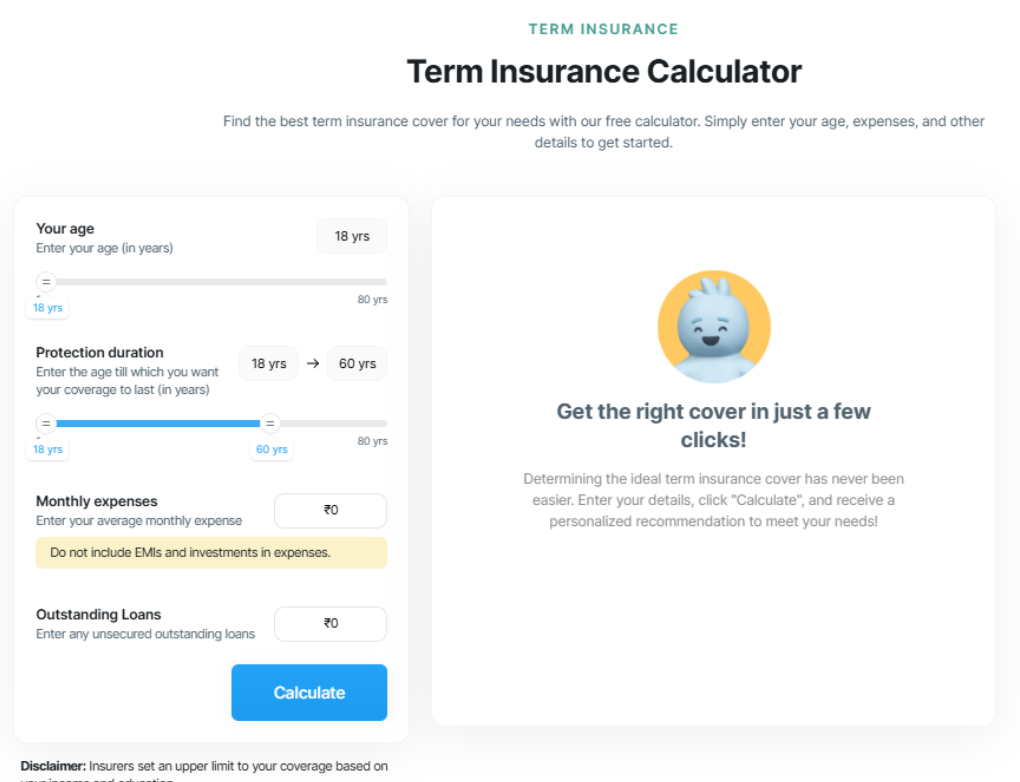

Another helpful tool that Ditto provides is the Term Insurance Calculator. It’s designed to help users find the right insurance cover based on their age, financial responsibilities, and protection needs.

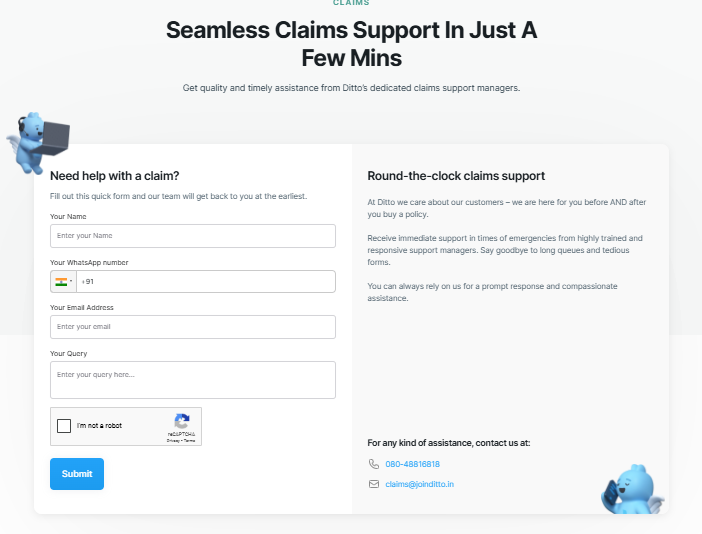

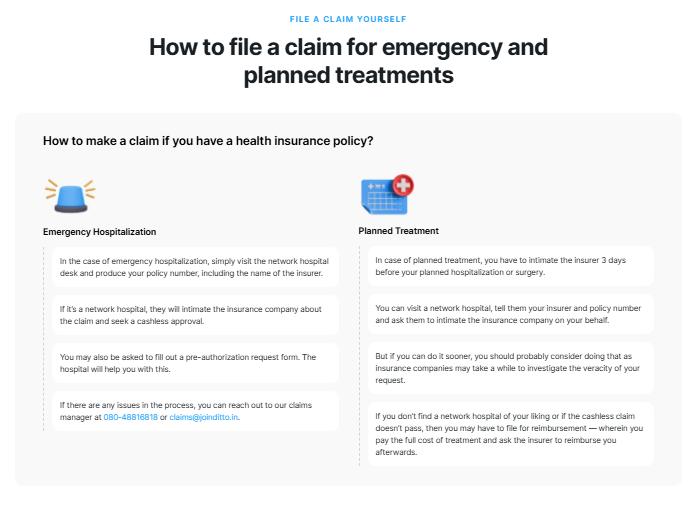

The Claims tab redirects users to another page, which is beautifully designed with a simple UI/UX.

Visitors get to see a simple and easy-to-understand form that they can fill up to get “claims” support from the Ditto team.

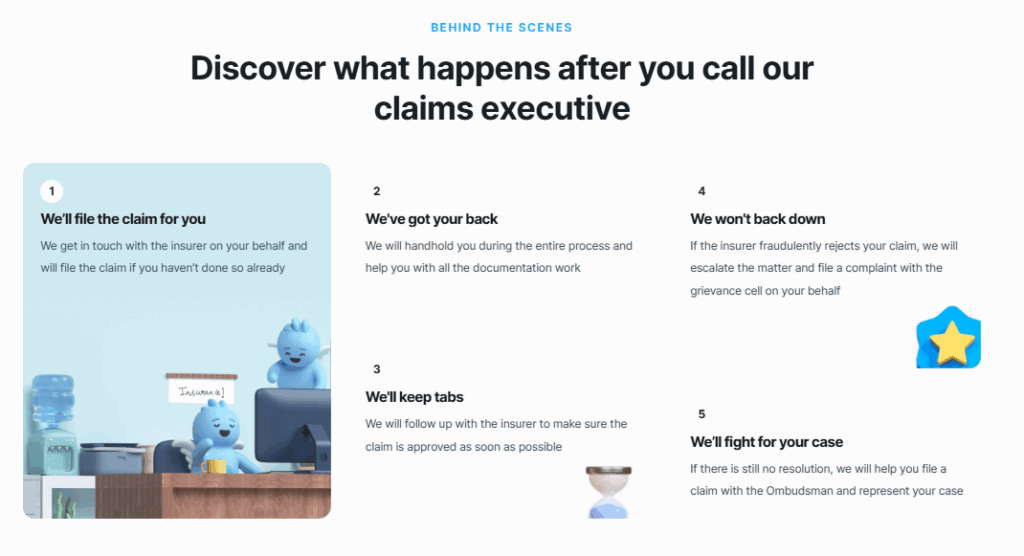

Users also get to see a well-designed infographic that shows them the entire process after they have filed their claims.

Users also get to see helpful infographics that show them the process for filing claims for emergency and planned treatments.

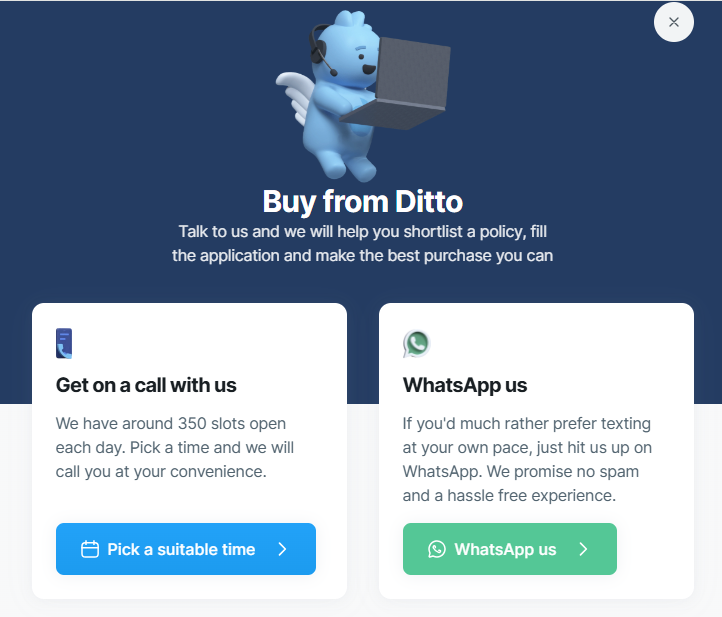

The “Buy Insurance” tab on Ditto’s website opens a clean, user-friendly pop-up that invites visitors to schedule a free call with an advisor.

Instead of taking users straight to a checkout or product comparison page, Ditto adopts a human-first approach by offering to help shortlist a policy, guide through the application, and then ensure a smooth purchase experience.

The footer of the page has yet another CTA that reinforces Ditto’s core philosophy, that insurance is not just about comparison, it’s about clarity.

Positioned with their friendly mascot and backed by Finshots, the message is simple, but at the same time, powerful.

Ditto maintains an active and approachable presence across key social media platforms, as seen in the footer with icons linking to YouTube, X (formerly Twitter), LinkedIn, Instagram, and Facebook. This multi-channel visibility helps them engage with diverse audiences.

Ditto’s Search Engine Optimization Game

We all know that good SEO practices are the backbone of any high-ranking website. With this being said, let’s look at the SEO scenario of Ditto.

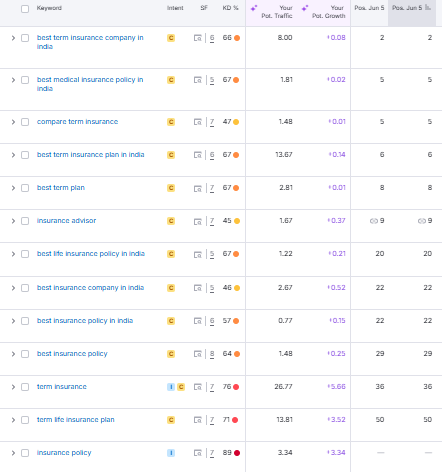

Their strategy was tailored to reach users across various stages of the insurance journey—from awareness to decision-making, by carefully targeting relevant keywords and creating content around them.

- Keyword Strategy

Ditto’s keyword approach was segmented into three main categories to maximize discoverability. They focused heavily on health insurance, term insurance, and policy comparisons such as “Star vs HDFC ERGO,” which are commonly searched during the decision-making phase.

Their informational keywords targeted users at the awareness level with searches like “” or “health insurance benefits.”

For users closer to conversions, they used commercial keywords such as “medical insurance policy in India” and “insurance advisor.”

Finally, they capitalized on long-tail keywords like “best term insurance company in India,” which indicated strong purchase intent.

Tools like Google Keyword Planner, SEMrush, and Ahrefs were used to identify opportunities, analyze competition, and fine-tune their content roadmap accordingly.

This structured SEO approach helped Ditto dominate niche insurance queries and attract qualified traffic without paid media.

- On-page SEO

Ditto’s on-page SEO was designed not just for search engines, but with a sharp focus on user experience and conversion.

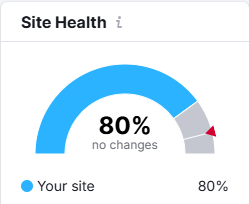

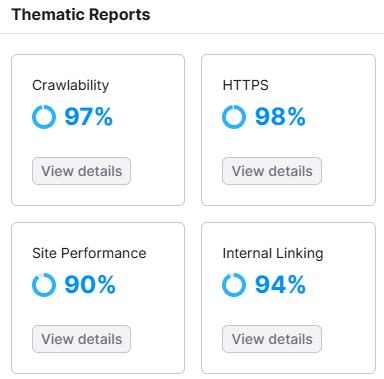

The image shows the site health of the Ditto website, which is 80%, which is a good number. However, there are some areas that can be improved upon.

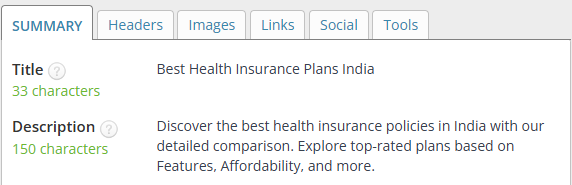

Meta Optimization

Each page featured carefully crafted meta titles and descriptions, incorporating primary keywords while maintaining clarity and click-worthiness to improve CTR from search results.

Header Structure

Keyword-rich H1s and H2s were used strategically to improve search relevance, while also ensuring readability.

They often used question-format headings, such as “What is Term Insurance?” or “Which Plan Should You Choose?”, which aligned directly with user search intent and improved engagement.

Each section answered a clear business or user pain point, enhancing time-on-page and relevance.

Mobile and Performance Friendly

Given that many users access insurance content on mobile devices, Ditto ensured their pages were fast-loading and fully responsive, contributing to better SEO scores and a seamless browsing experience.

Clear Navigation & CTAs

Every page followed a well-defined CTA hierarchy, guiding users with clear prompts like “Buy Insurance” or “Find a Time to Talk.”

The site also offered intuitive section navigation, helping users quickly jump to relevant information, which improved usability and boosted conversion likelihood.

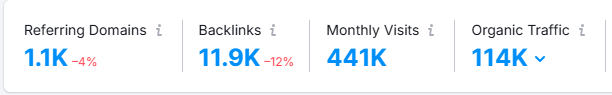

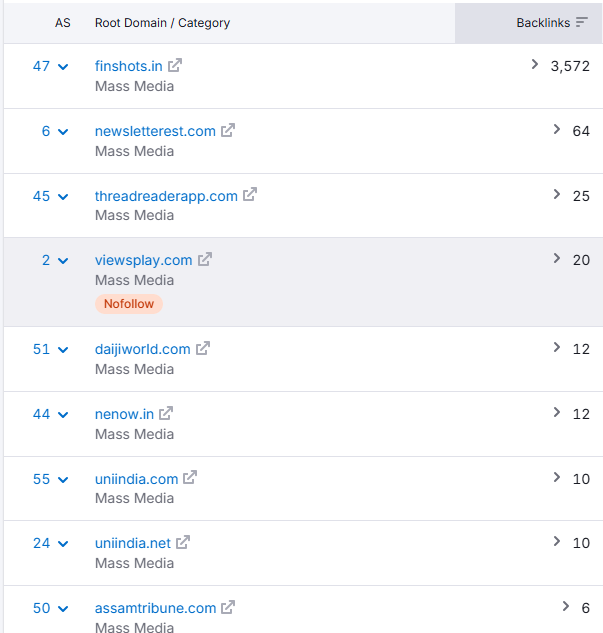

Backlink Strategy

To boost their domain authority and rank for competitive insurance-related keywords, Ditto adopted a multifaceted backlink strategy focused on both quality and relevance.

Editorial Mentions

The brand secured features in high-authority publications like The Economic Times and Entrackr, which not only enhanced credibility but also provided powerful backlinks from trusted sources. These mentions positioned Ditto as a thought leader in the insurance space.

Guest Posts

Ditto contributed insightful articles to well-established finance blogs and insurance-focused platforms. These guest posts helped build contextual backlinks while simultaneously reaching a highly targeted audience interested in financial planning and insurance.

Job Postings

Interestingly, even their recruitment strategy played a role. Job listings on platforms like Freshteam and others contributed to a growing and diverse backlink profile, showing search engines ongoing business activity and legitimacy.

Educational Collaborations

Ditto also partnered with educational institutions, like the placement cell of Dyal Singh Evening College. These collaborations often led to backlinks from .edu domains, which are highly valued in SEO for their trustworthiness and rarity, further enhancing Ditto’s domain strength.

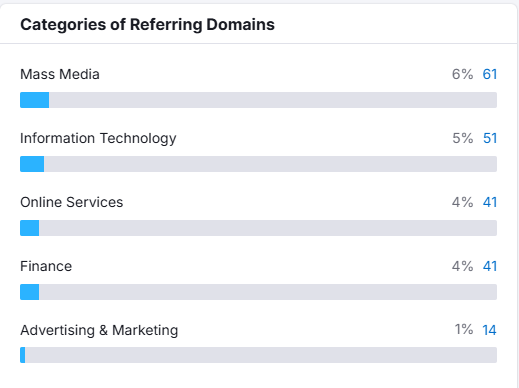

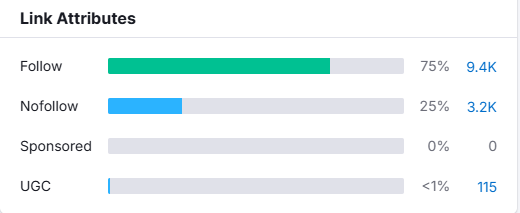

NoFollow vs DoFollow Strategy

Ditto’s backlink strategy was built on a smart balance between DoFollow and NoFollow links, each serving a distinct purpose in their SEO and branding efforts.

DoFollow Links

These were prioritized in high-impact areas such as guest posting and editorial features, as they pass on link equity and directly contribute to improving search engine rankings. Securing DoFollow links from reputable sites helped boost Ditto’s domain authority and visibility on competitive keywords.

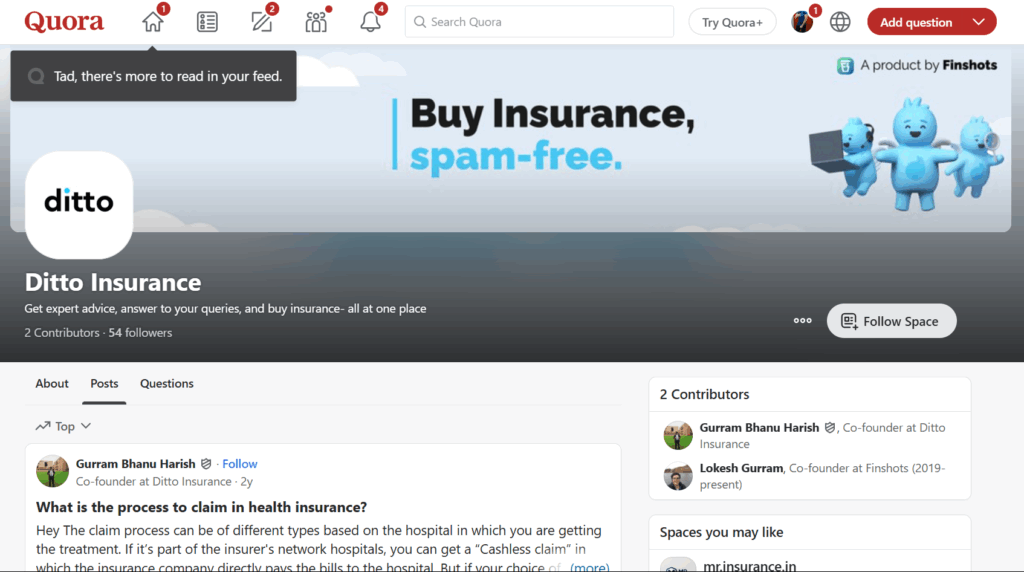

NoFollow Links

While NoFollow links don’t pass SEO value, Ditto still leveraged them effectively on platforms like Reddit, Quora, and Medium.

These links brought referral traffic, expanded their brand presence, and positioned Ditto in conversations where insurance advice was being actively sought by users.

Balanced Approach

Ditto maintained a healthy backlink ratio of approximately 75% DoFollow to 25% NoFollow, ensuring strong SEO gains while keeping the link profile natural and diverse, an important signal to search engines for long-term credibility.

Ditto’s Content Strategy

Ditto’s content marketing strategy followed a structured Content Pyramid Framework, ensuring they addressed every stage of the customer journey, from awareness to consideration to decision-making. This layered approach not only built trust but also nurtured leads efficiently through high-quality, targeted content.

Top of the Pyramid (TOFU): Attract & Educate

At the awareness stage, Ditto created beginner-friendly blog posts designed to attract a broad audience and simplify complex insurance topics. These articles catered to users who were just starting their research and might not yet be ready to buy.

A few examples of their TOFU content include:

- Hospicash: A Guide to Hospital Cash Insurance – educating readers on lesser-known benefits like daily hospital cash.

- AYUSH Health Insurance: A Guide to Holistic Coverage in India – introducing alternative healthcare coverage under Indian insurance policies.

These articles helped build trust and drive organic traffic by addressing common questions and health finance concerns.

Middle of the Pyramid (MOFU): Compare & Evaluate

For users moving into the evaluation phase, Ditto produced comparison-based content that helped potential buyers weigh their options more clearly.

These in-depth blogs focused on specific product comparisons and addressed typical consumer dilemmas like choosing between top insurers or understanding the value of term insurance.

Some examples of their MOFU content pieces include:

- TATA AIG Vs Star Health Insurance: Which One Should You Choose? – a detailed side-by-side comparison of features, premiums, and claim processes.

- Is Term Insurance Worth it in 2025? Everything to Know – an exploration of pros, cons, and trends around term insurance, tailored to a future-forward audience.

This content helped position Ditto as a transparent advisor rather than a seller, which was critical for building credibility.

Bottom of the Pyramid (BOFU): Convert with Confidence

At the decision-making stage, Ditto used case studies, reviews, and real-life examples to push high-intent users toward conversion. These content pieces were more specific and often included product reviews or customer experiences, helping users validate their choices.

Some examples of their BOFU content pieces are:

- Pramerica Life Insurance Review – an honest evaluation of a specific life insurance provider, discussing pros, cons, suitability, and features.

This BOFU content provided the final reassurance needed to convert warm leads into paying customers, all while reinforcing Ditto’s unbiased, customer-first positioning.

Ditto’s Social Media Strategy

Ditto’s social media strategy is built around education, trust, and relatability. Instead of hard-selling insurance, their content simplifies complex topics through reels, infographics, and bite-sized posts, making insurance less intimidating and more human.

Platforms like LinkedIn and Instagram are used to share advisor stories, customer FAQs, and Finshots-style explainers, while YouTube features deeper dives and walkthroughs.

Instagram Strategy

Followers: 81.6k

Ditto’s Instagram strategy is all about making insurance feel human, not transactional. Their content mixes education with empathy, using short, relatable reels, carousels, and story highlights to break down insurance jargon into bite-sized, easy-to-digest insights.

From common myths and policy tips to behind-the-scenes glimpses of their advisors, Ditto creates a feed that informs without overwhelming.

Facebook Strategy

Followers: 1.7k

Ditto Insurance’s Facebook strategy combines provocative storytelling and consumer education to drive engagement. Posts highlight real-life insurance issues, like claim denials or scams, using attention-grabbing headlines (“This Claim Was Rejected Over a Clause THAT DIDN’T EXIST!”). By framing complex topics as relatable narratives, Ditto positions itself as a transparent advisor.

LinkedIn Presence

Followers: 125k

Ditto Insurance’s LinkedIn carousels expose insurance frauds and industry malpractices through hard-hitting, data-driven storytelling. The posts break down scams, like hospitals faking procedures or agents forging documents, into digestible slides, blending shocking revelations (“Some cases are as small as ₹20,000”) with actionable insights.

By spotlighting real FIRs and consequences, Ditto positions itself as an industry watchdog, educating professionals while reinforcing its brand as a transparent, consumer-first advisor.

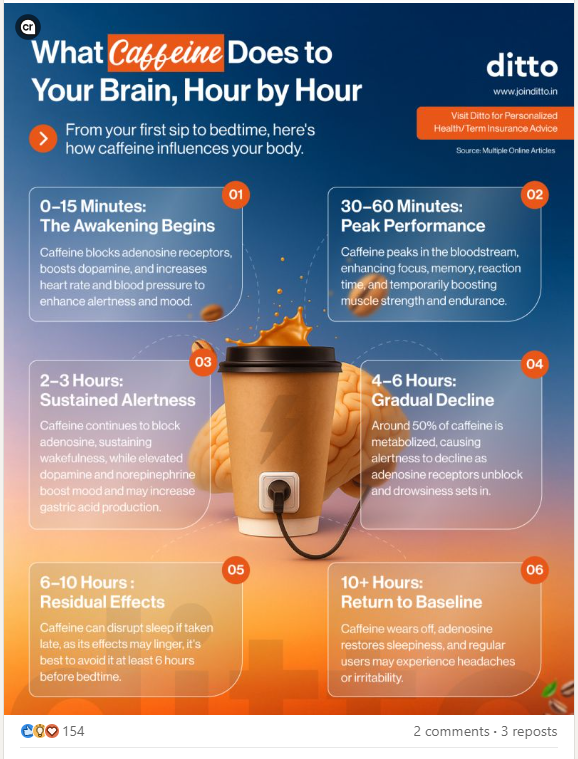

Though not directly insurance-related, content like this aligns with Ditto’s broader mission of empowering informed decisions (health habits).

The closing call-to-action (“Visit Ditto for health/term insurance advice”) ties the engagement back to its core services, leveraging curiosity-driven learning as a hook for trust-building. This strategy positions Ditto as a knowledge hub, not just a seller, fostering credibility in a cluttered market.

YouTube Presence

Subscribers: 39.6k

Ditto Insurance’s YouTube strategy focuses on high-value, search-driven educational content that addresses common insurance dilemmas with urgency and expertise.

The channel’s videos, like “Don’t Buy Term Life Insurance Before Watching This” or “Best Maternity Insurance in India”, target high-intent buyers by debunking myths, comparing plans, and simplifying complex topics (e.g., Ayurveda coverage).

Titles use provocative hooks (“WORTH BUYING IN 2025?”) and SEO-friendly keywords to capture organic traffic.

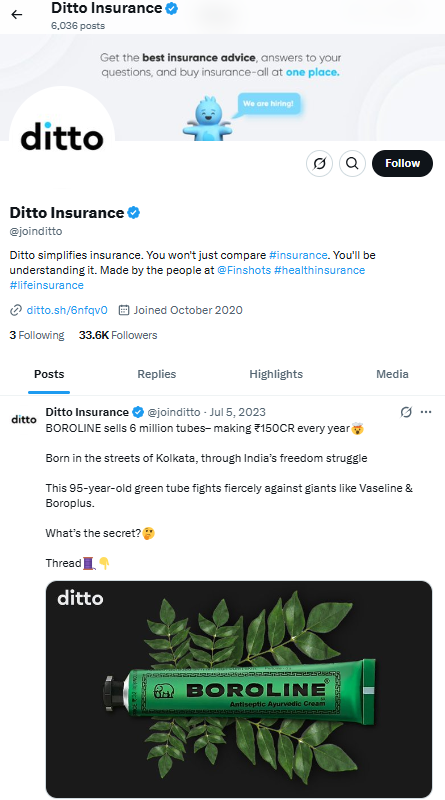

Ditto’s Twitter Presence

Followers: 33.6k

Ditto Insurance uses a smart and engaging Twitter strategy to make insurance interesting and easy to understand.

Instead of using heavy jargon, they simplify complex topics with clear language and relatable examples. Their posts often use storytelling, like the viral Boroline thread, to connect with a wider audience. They mix finance, history, and everyday topics to grab attention and spark curiosity.

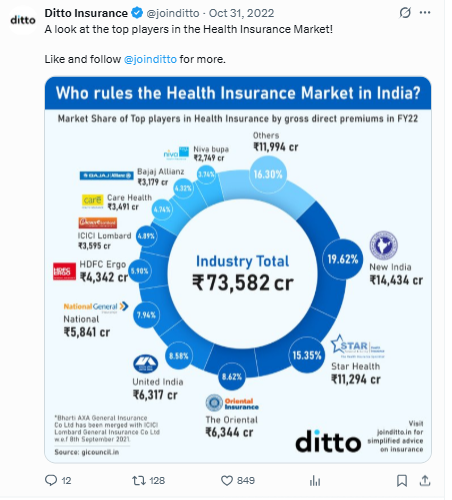

This post shows how Ditto Insurance uses data-driven content to educate and engage its audience.

By sharing clear visuals like the health insurance market share chart, they make complex financial information easy to digest. The use of bold numbers, brand logos, and a clean layout grabs attention while delivering value.

Their strategy of mixing educational insights with visual storytelling helps build trust and encourages users to follow for more updates.

PPC Strategy

Ditto’s Pay-Per-Click (PPC) campaigns were tailored to engage high-intent users and drive bottom-of-the-funnel conversions. The campaigns were focused on a clearly defined audience segment that was both digitally active and insurance-curious.

Target Audience

The campaigns primarily targeted young urban professionals aged 25–40, especially those navigating life milestones such as marriage, parenthood, or first-time home buying, common triggers for insurance purchases. These were first-time insurance buyers, often overwhelmed by choice and looking for simplified, trustworthy guidance.

Demographically, the audience skewed toward salaried individuals from the upper middle class to high net-worth brackets, who had disposable income and were actively searching for health or term insurance. Geographically, the focus was on tech-savvy users in Tier 1 cities like Mumbai, Bangalore, Delhi, and Pune, locations known for higher internet penetration, digital literacy, and online buying behaviour.

Through targeted ad creatives and keyword bidding strategies, Ditto’s PPC efforts ensured their message reached the right users at the right stage, driving both inquiries and conversions effectively.

Google Ads

Ditto ran highly targeted Google Search campaigns designed to capture bottom-of-funnel traffic—users actively looking to buy or compare insurance policies. The keyword strategy focused on high-intent search terms like “buy health insurance”, “term insurance advisor”, and “free insurance consultation”, ensuring ads appeared for users closest to making a decision.

Ad Messaging:

The ad copy was concise yet persuasive, using action-driven phrases like “Compare Term Policies” and “Compare and Buy Term Plan Now”.

Messaging reinforced Ditto’s core brand promises, such as “Strict No Spam Policies” and “24/7 Claims Assistance”, addressing the two most common user concerns, which are privacy and post-sale support.

Ad Extensions:

To improve CTR and guide users to relevant pages, Ditto used strategic ad extensions:

- Sitelinks led directly to high-converting pages like Health Insurance, Term Insurance, and Claim Assistance.

- Callout extensions highlighted trust signals such as “IRDAI Certified”, “Backed by Zerodha”, and “24×7 Support”, boosting credibility.

- Call extensions were enabled on mobile devices, allowing potential customers to speak with an advisor directly, adding a human touch to digital advertising and speeding up conversions.

This mix of keyword precision, value-driven copy, and trust-building extensions made Ditto’s search campaigns both cost-effective and conversion-focused.

Display Campaigns (Google Display Network)

Banner Ads Strategy

Ditto’s banner ad campaigns were strategically designed to retarget bounced visitors—users who showed interest but didn’t convert—within a 7–14 day window. This retargeting window kept the brand top-of-mind without overwhelming the user, giving them time to reconsider their insurance needs.

Targeted Placements

Banner ads were placed on finance, careers, and lifestyle websites, aligning with the browsing habits of their core audience: salaried professionals, job seekers, and financially aware individuals. These placements ensured Ditto appeared in relevant contexts, increasing the chances of re-engagement.

Creative Variants

A mix of static visuals and HTML5 motion banners was used to maintain variety and improve engagement rates. Motion creatives were subtle yet effective, drawing attention without being intrusive.

Social Proof Integration

Many banners included testimonial quotes, such as: “Ditto helped me understand my policy without pressure.” This humanised the brand and addressed user hesitation by showcasing real customer experiences—an essential trust-building move in the insurance industry.

Meta Ads (Facebook & Instagram)

Meta Ads (Facebook & Instagram)

Ditto leveraged Meta platforms—Facebook and Instagram—to run high-converting lead form campaigns targeted at mobile users who prefer quick, low-friction interactions.

Lead Form Campaigns

The forms were intentionally kept minimal, asking only for Name and Phone Number to reduce drop-offs and maximise submissions. This simplicity made it easy for users to take the first step without committing to a full consultation immediately.

Ad Hook

The primary hook used was thought-provoking and emotionally resonant:

“What’s your family’s financial Plan B?”

This line tapped into the core anxiety around financial security, especially among young professionals and parents, prompting them to pause and consider life insurance seriously.

Combined with clear branding and warm visuals, these Meta ads struck the right balance between urgency and empathy, which helped drive thousands of qualified leads into Ditto’s advisory funnel.

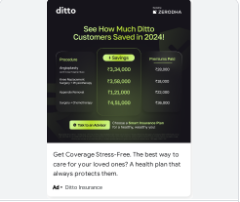

- Video & Carousel Ads

To further engage and educate potential customers, Ditto deployed video and carousel ads across Facebook, Instagram, and YouTube, focusing on transparency, ease of use, and human connection.

UI-Focused Carousel Ads

These showcased Ditto’s booking flow through a series of clean, swipeable visuals, demonstrating how simple it is to schedule a free insurance consultation.

Each frame walked users through steps like choosing a policy type, selecting a time slot, and speaking to an advisor. This visual walkthrough reduced hesitation and encouraged interaction by demystifying the process.

Video Ads with Real Advisors

Short, bite-sized video clips featured Ditto advisors explaining complex insurance terms, like “term riders” or “hospital cash” benefits, in plain, conversational language. These clips built trust by putting real faces to the brand and reinforced Ditto’s human-first approach: unbiased advice, with no jargon and no pressure.

Together, these ad formats added depth to Ditto’s digital strategy by making the product experience tangible, relatable, and easy to understand, qualities that matter most in the insurance-buying journey.

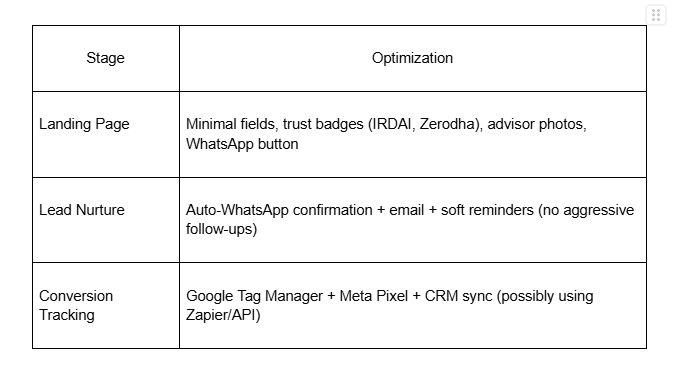

Targeting Strategy & Funnel Optimization

Ditto’s paid media campaigns were sharply tuned using both first-party and behavioural data. They built lookalike audiences based on their existing CRM and engaged users from the Finshots newsletter, a highly relevant group already inclined toward financial content and decision-making.

In parallel, they retargeted Instagram engagers, especially those who interacted with carousel or video content, bringing warm leads back into the funnel. Demographic filters focused on users aged 25–40 from Tier 1 metro cities (like Mumbai, Bangalore, and Delhi), with strong interest signals in fintech, term insurance, financial planning, and startup culture.

Funnel Optimization Techniques

Ditto Competitors

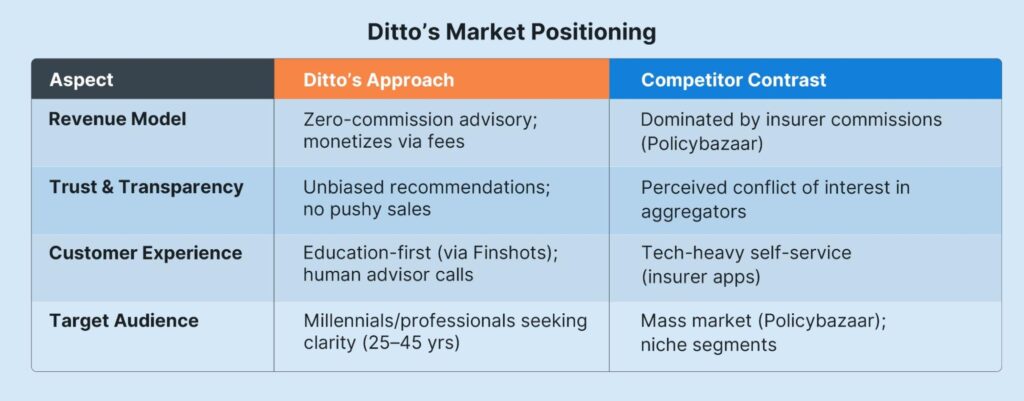

Ditto Insurance operates in India’s rapidly evolving insurtech sector, competing with a mix of traditional brokers, digital marketplaces, and insurer-owned platforms.

Here’s a breakdown of key competitors and Ditto’s market positioning:

Major Competitors

- Policybazaar

Dominant Player: India’s largest insurance marketplace (backed by SoftBank, Tencent).

Model: Aggregator platform listing policies from 50+ insurers; heavy advertising (TV, digital).

Strengths: Massive brand recognition, wide product range, instant policy issuance.

Weakness: Sales-driven culture; perceived bias toward high-commission plans.

- Coverfox

Position: Digital broker with a focus on health and term insurance.

Model: Hybrid tech-human advisory; partnerships with insurers like HDFC Ergo.

Strengths: Strong tech stack, multi-channel support.

Weakness: Less emphasis on education; narrower brand recall than Policybazaar.

- Insurer Direct Platforms (e.g., HDFC Life Portal, ICICI Lombard Direct)

Model: Insurers selling policies via proprietary apps/websites.

Strengths: Pricing control, bundled discounts, customer loyalty.

Weakness: Limited choice; inherently biased toward own products.

Ditto avoids head-on competition with mass-market players by focusing on high-intent and educated buyers who value transparency over speed. This positions it as a trusted name in a cluttered market.

Final Thoughts

Ditto’s marketing stands out in a crowded and confusing insurance market by doing one simple thing right: putting people first. Instead of chasing clicks or pushing products, Ditto focuses on building trust through clear content, real human help, and zero spam.

In a space full of noise, Ditto proves that being honest, helpful, and human is the best way to grow!

Need your marketing game to be on point?

From SEO that ranks to websites that convert, Nico Digital is your growth partner every step of the way.

Let’s turn clicks into customers! Book your free strategy call today.